Coursera Financial Markets

Notes from Coursera Financial Markets Course.

VaR - value at risk

- concept created after stock market crash after 1987

- quantify risk of investment or portfolio

- units $ for a given probability and time horizon

Stress Tests

- method of accessing risks to firms or portfolios

- see how firm will stand up under crisis

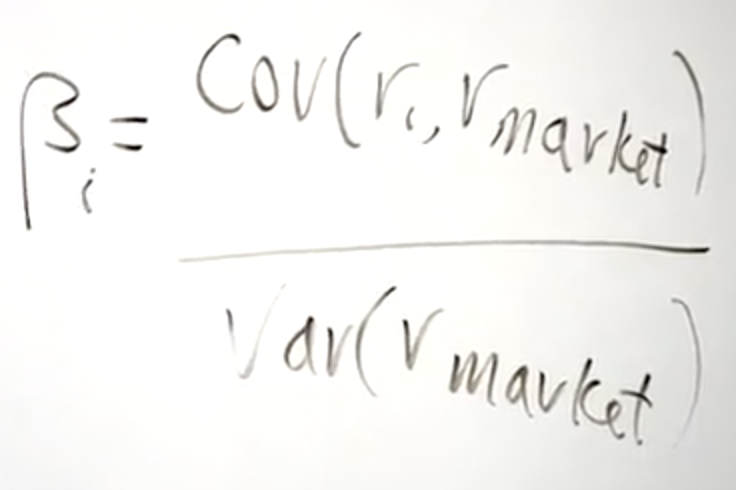

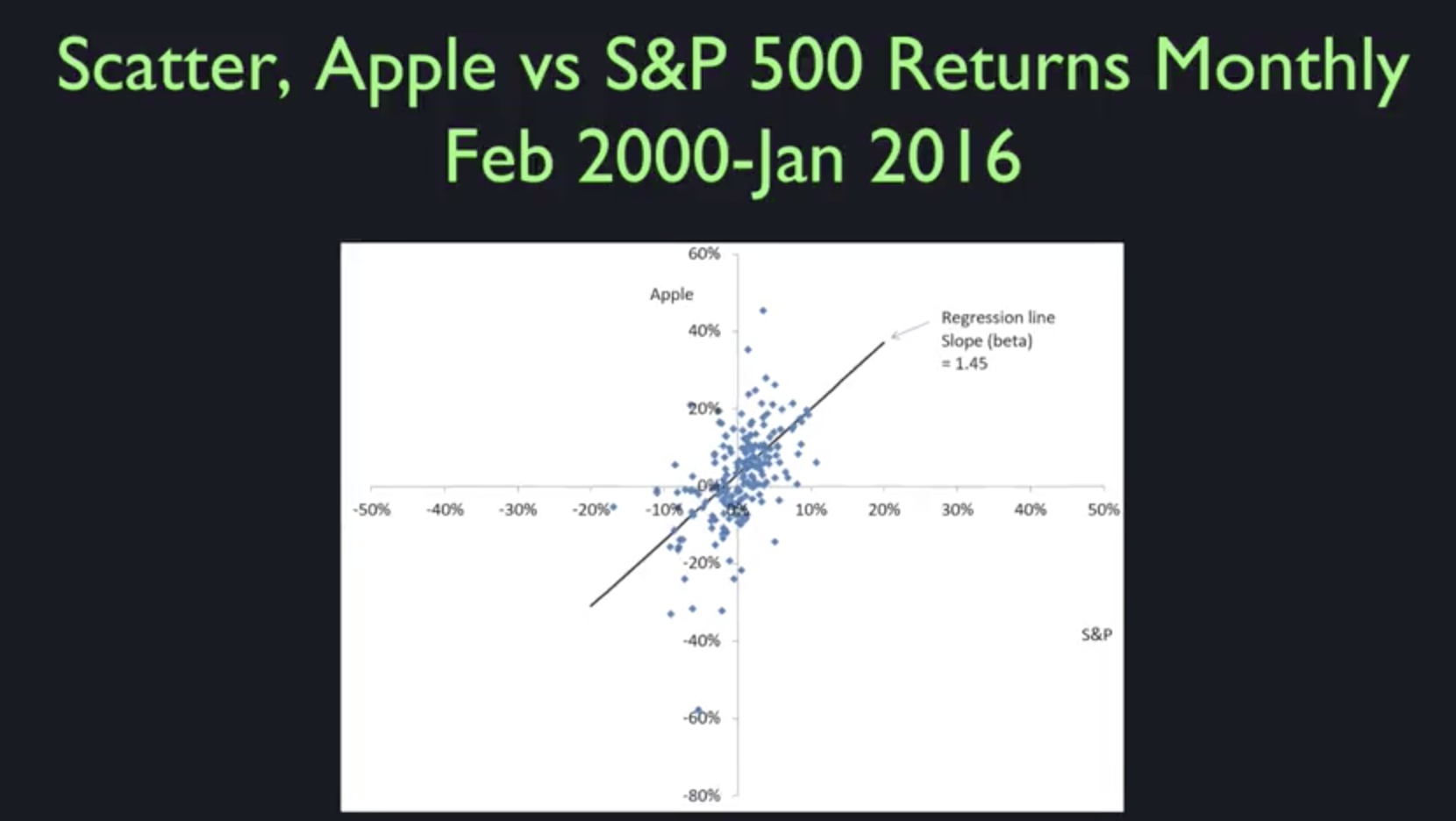

Beta - measure of how a stock price relates to the aggregate market

-

Market risk vs Idiosyncratic Risk (e.g. Steve Jobs Death)

-

Skatter Plot Regression Line - best fits data

-

Residual - distance between line and dot. Best fit = lowest residual sum for all dots

-

line equation y = mx + b.

- m is slope (how much y changes for 1 unit increase in x)

-

y is return on stock, x is return on market, m as beta, b is alpha in finance

- beta how much a stock co-moves with market (systematic risk)

-

-

-

Capital Asset Pricing Model:

- variance of stock return = beta ^ 2 X <variance of market return> (systematic risk) + <variance of residual in the regression> (Idiosyncratic risk)

-

-

Gold is negative beta. (negatively correlated to market returns)

- Help offset market shock.

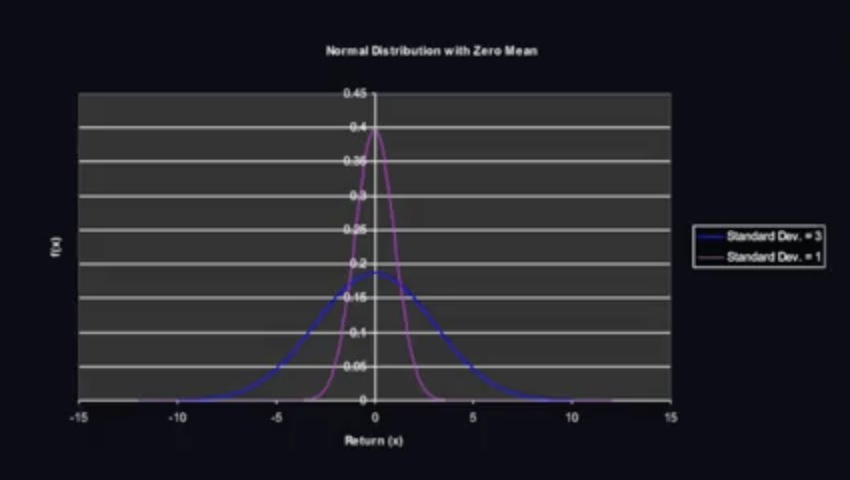

Normal Distribution - Standard deviation 1,3

Finance does not follow Normal Distribution— tends to have fat tails

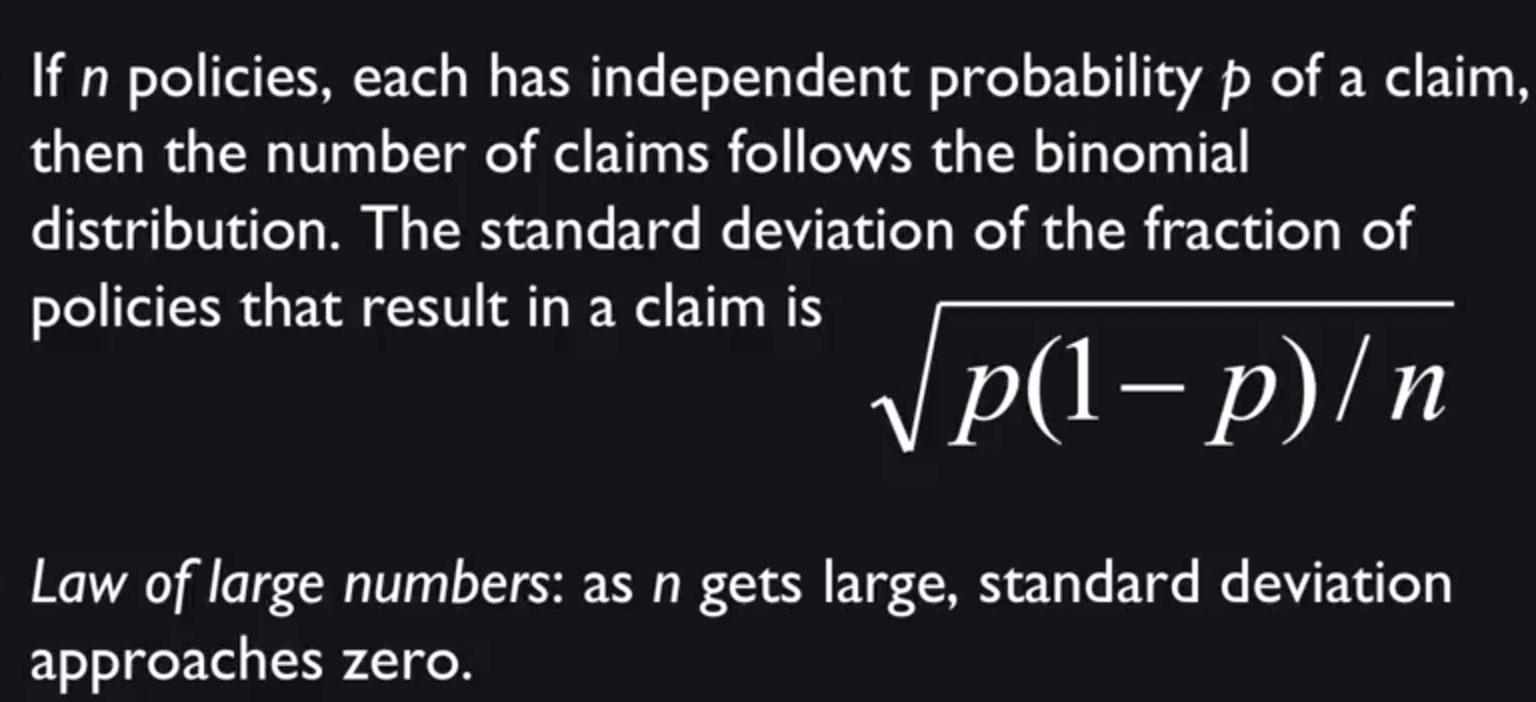

The standard deviation is √(p(1-p)/n)

Central Limit Theorem - Averages of a large number of independently identically distributed shocks are approximately normally distributed

- Can fail if underlying shocks are fat tailed (e.g Black Swan) or lose their independence

-

Cauchy Distribution - fat tail distribution

- Can get tricked into thinking fairly stable w/ risk I understand

- Stock price changes: -20%/+12% in single day

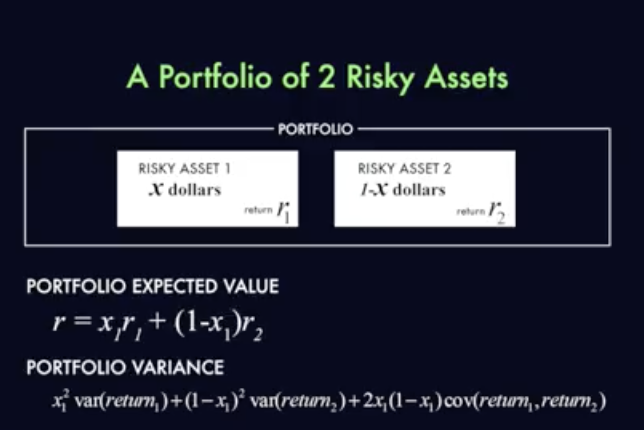

Covariance

-

Example, 2 startups with .5 probability of 1 million income and .5 for 0 (mean .5)

- COV = .25(.5*.5) (both succeed) + .25(-.5*.-5) (both failing) + .5(-.5*.5) (one succeeds and the other doesn’t. twice as likely since 2 ways it could go) = 0

-

Probably-weighted average.

- If independent, COV is 0. Good as an investor.

- ** Risk is determined by covariance!

- The market demands higher returns for the high beta stocks (high covariance with the market)

Insurance

- Risk Pooling - source of value in insurance

-

Not always easy to make idea work b/c of:

- Moral Hazard - take more risk b/c of insured

-

Selection Bias - insurance company can not see all risks e.g. Health Insurance attracts sick people

- aka Adverse selection

- Idea to guard against: For crop insurance, iInsure weather instead of crop

- McCarren Ferguson Act 1945 delegated insurance regulation to states.

- National Association of Insurance Commissioners (NAIC) creates standardized suggested laws.

Capital Asset Pricing Model (CAPM)

- Model of optimized portfolio. Asserts that every investor will hold that portfolio.

- Individuals should diversify, but it is difficult b/c have to buy fractional shares (use investment funds)

Credit Default Swap -

Short Sales - hold negative quantities of a stock.

- Can’t be part of optimal portfolio.

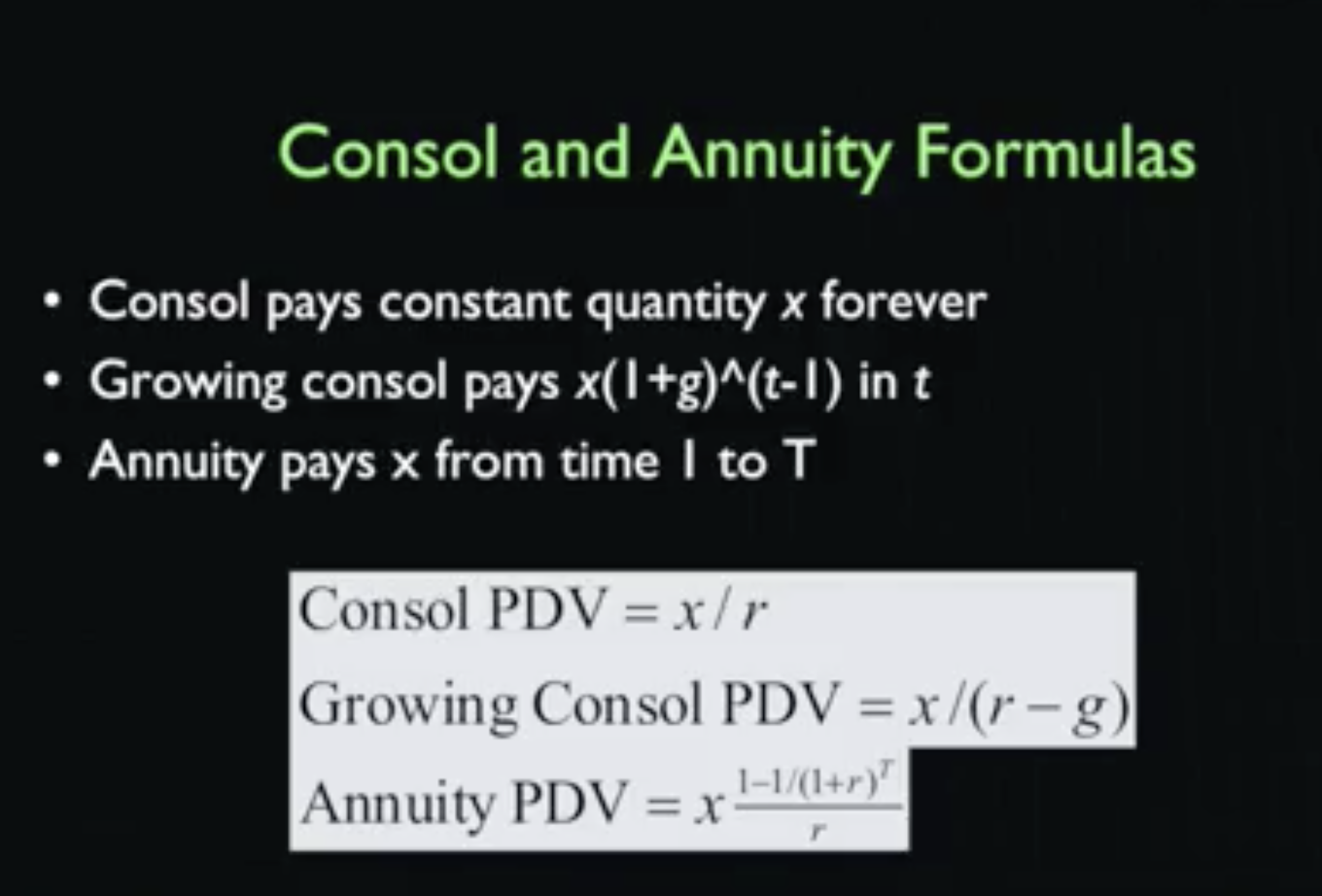

** Gordan Growth Model - present value given future growth

-

PV = x / r - g, where x is output at time of purchase, r is rate of discount, g is growth rate.

- g must be less than r

Limited Liability

- investors in stock can never be pursued for mistakes of company

- works b/c investor overemphasizes risk (like inversely lottery ticket)

- allows diversified portfolio

Inflation Indexed Debt

Unidad de Fomento - Unit of Development (Chile 1967) - Unit of account tied to consumer price index

Representativeness heuristic - something seen in the past is representative of what we’ll see in the future

Random Walk Hypothesis - Each change is independent of previous changes and totally unforecastable

Efficient Market Hypothesis - revolution in the 50s

PDV of stock (Gordon Model): P = E/(r-g) or P/E = 1/(r-g)

- says P/E should be the same for every stock

Behavioral Finance

- ppl want praise

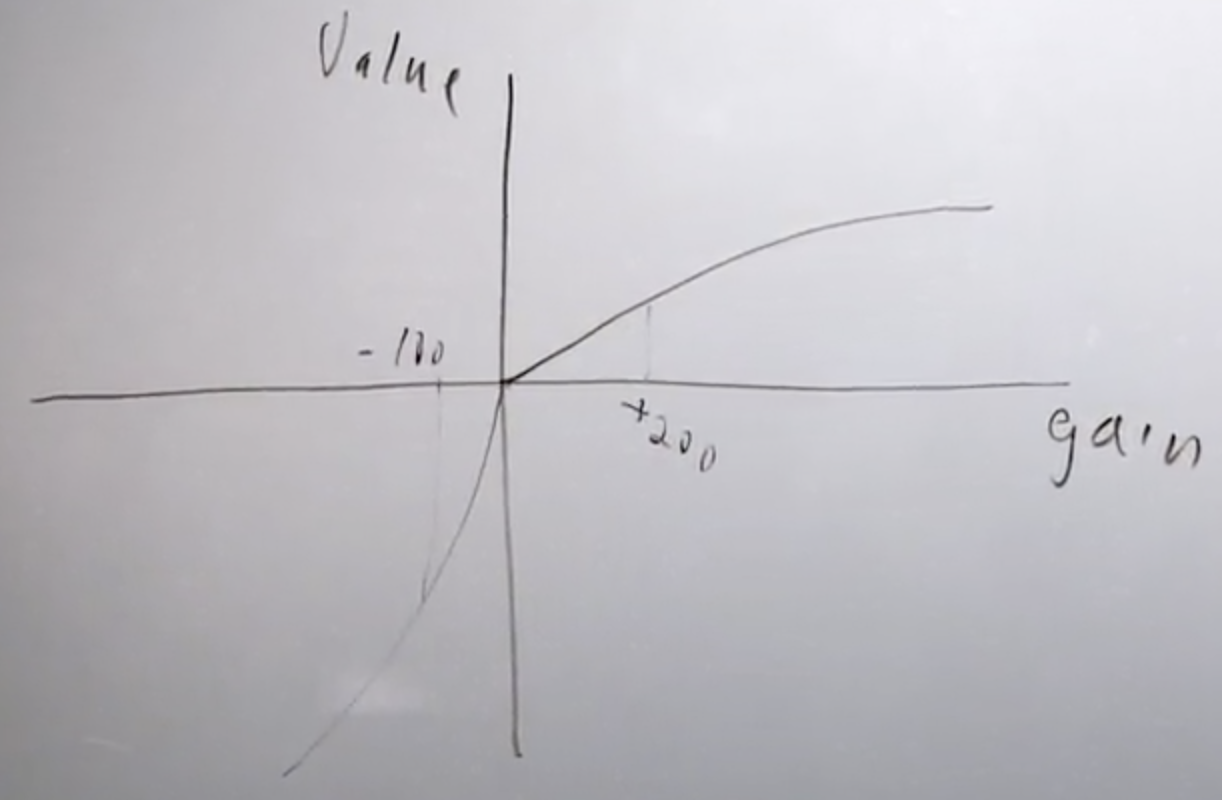

Prospect Theory - revolution in the 90s

- Old Theory: Utility Function

-

New Theory: Value Function - Utility dependents on reference point

-

People have skewed representations of probabilities:

- People will not take small bets, but worry about small gains/losses.

- People are willing to take large bets to get back to positive.

- (0,0) is present time. Always a kink. Steeper curve for lose side— loss aversion.

-

Wishing Thinking Bias e.g. My team has higher chance of winning

Overconfidence in people e.g. Hiring a CEO

Cognitive Dissonance - mental conflict that occurs when one learns one’s beliefs are wrong i.e. avoidance behavior

- Disposition Effect - Will ignore bad memories

Mental Compartments - fun vs. retirement portfolios

Attention Anomalies - e.g. everyone paying attention to same stock == inflated prices

Anchoring - stock prices are anchored to past prices

Disjunction Effect - inability to make desicision that is contingent on future infomation

Newcomb’s paradox - People sometimes change their behavior when they learn about a prediction which has been made about the future.

Magical Thinking - i.e.. superstitions

Federal Funds Rate - shortest term interest rate (overnight), only banks

- Target rate by federal reserve

- EONIA (European Over Night Index Average) - European equivalent

Causes of Interest Rates

- Technological progress i.e. rate of progress is about 3%

- Time preferences i.e. people are natural impatient

- Advantages to roundaboutness e.g. pay an farmer to grow more so you can buy it

Compound Interest - (1 + r/n)^nt, where n is the number of times compounding per year

- Continuously: Pe^rt

Discount Bond

- No coupon payments, buy at discount

- Term T, Yield to Maturity (YTM) r: P = 1/(1 + r)^r, P < 1

Present Discounted Value: PDV = 1/(1 + r) ^ n ** Important thing to calculate

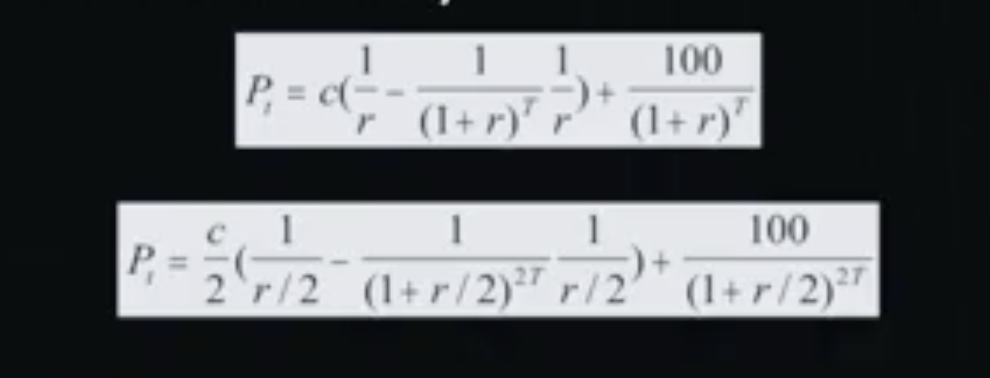

Conventional Coupon Bond

- Issued at par e.g. not discount

- Annual vs 6-month compounding

** Market risk of bonds: coupon is fixed, but market price of bond fluctuates

- Consols like land

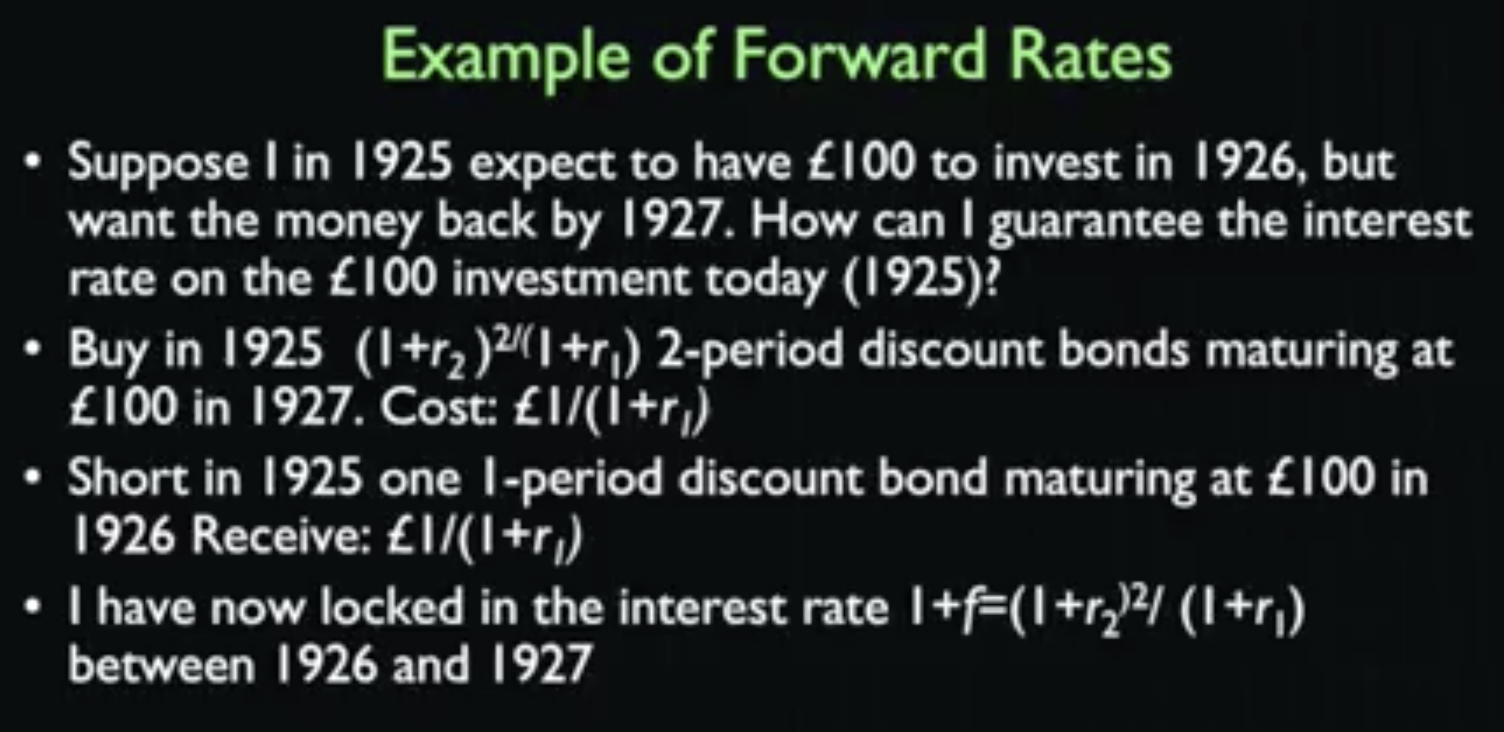

Forward Rates - interest rates that represent future bond interest rates ???

Inflation and Interest Rates

- Nominal rates (not taking into account inflation) are quoted in dollars

- Real rates are quoted market baskets

- Indexed bonds (TIPS) - pay in real rates

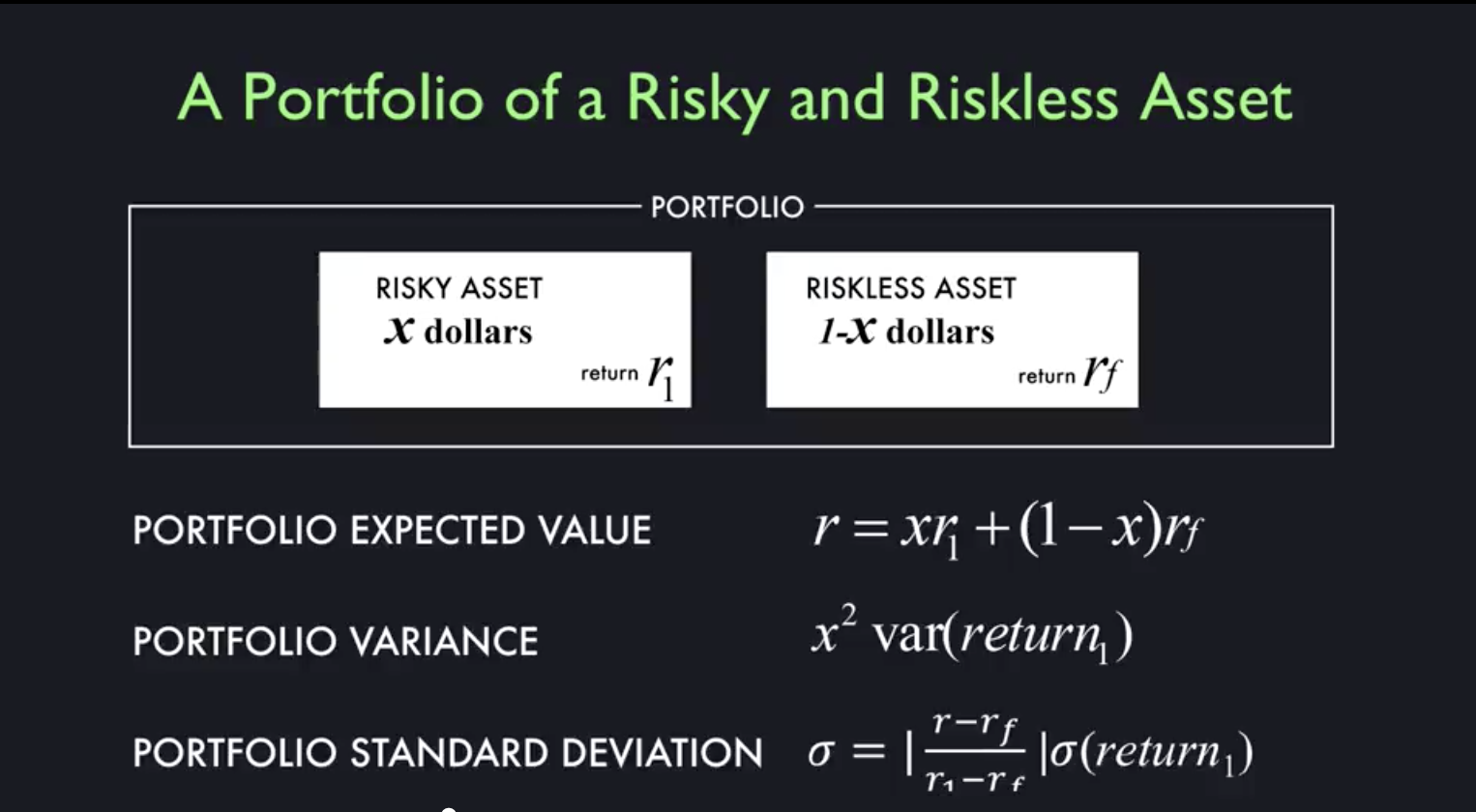

Leveraging - putting more money in the asset than you have

Market Capitalization - price per share X number of shares of common stock (US 151% of GDP)

Common (equity vs Preferred Stock - preferred has a specified divined which does not grow through time; does not need to be paid

- can’t pay common dividend until preferred is paid

Stock dividend - pay dividend in stock

- Dilution

Share repurchase - same as dividend, but tax break

PDV of Expected Dividends (Gordon Model): P = E/(r-g) or P/E = 1/(r -g)

- Low P/E means r is high or g is low

-

expected return on a stock is a function of it’s covariance with the market

- Riskier if covary with market

- Stocks that covary should have high r and low P/E

- Value investing says invest in low P/E

Lintner Model of Dividends = dividends correspond to earnings

Inverted Yield Curves - short term interest rate are above long term rates

-

Indicator of recession

- Sometimes on purpose to combat inflation

Commercial Real Estate

Real Estate Partnerships

-

Direct Participation Program (DPP)

- Flow through vehicles

- For accredited investor

- Can’t be perpetual

Limited Partnership

-

General partner runs the business and does not have limited liability (LL)

- Must own at least 1%

-

Limited partners are passive investors w/ LL

REITs (Real Estate Investment Trusts)

-

Restrictions prevent regular businesses from becoming REITs

- e.g. Must pay out earnings

Mortgages

Good investment : house price below construction cost in area on the up

30-year mortgage rate tracks 10-Year Treasury

CMO - Collateralized Mortgage Obligation - pool of mortgages sold to investors

-

traunches e.g. AAA

- reached into higher traunches

CDO - Collateralized Debt Obligation - same thing as CMO except w/ different forms of debt

MicroPrudential - regulation to protect one person

MacroPrudential - protect whole system

5 levels of regulation:

1. Within-firm regulation

-

Board of Directors

-

Tunneling - minority of shareholders steal money

-

More common in civil law countries

2. Regulation set by trade group

3. Local regulation

4. National regulation

- Civil Law = laws are only est. by legislature

- Common Law = leg. and courts

5. International regulation

Public securities - approved by SEC, have to make quarterly filings

FASB - Federal Accounting Standards Board

-

Defines GAAP

- Net Income

- Operating Income = revenue - cost of doing business

Securities Investor Protection Corporation (SIPC) - like FDIC - protect account at brokers

Forward contract - contract to deliver at a future date (exercise date) at certain price (exercise price)

- Example: Farmer sells to warehouse

- Storage of grain is the hedger

- Can also be used with currency

-

Problem: can’t get out of them, trust

- Future’s market is way to overcome problems

-

Like a pair of zero coupon bonds

- Forward Rate reflects interest rates in 2 currencies

Forward Exchange Rate = Spot Exchange Rate * (1 + <interest rate currency 1>)/(1 + <interest rate currency 2>)

Future contracts

- standardized retail product

- Rely on margin calls to guarantee performance

- Fair value = spot price * (1 + r + s) where r is interest rate, s is storage cost

Options - used to manage risk e.g. put a floor on loses.

Call option - right to buy

Put option - right to sell

- Unlike Forward Contract, not bound to buy/sell

Exercise date - option expires

Exercise price - price at which buy/sell

Underly - underlying asset

Put-Call Parity Relation

- You don’t need put/calls because they are related through the put-call parity. Only for convenience.

- Price of Stock = Call Price + PDV Strike + PDV Dividends - Put Price

-

Closed-end fund - like Mutual Fund except buy individual funds

Inequality is due to unmanaged risk.

Human Capital

- Study risk management and finance

- Think about your positioning in history. How do I fit in to historical events happening right now? Rather than thinking about personal life cycle.

- Maintain human capital in changing world. Keep thinking about what skills you have will be important and needed by others under maybe different conditions